SBI Saving Account Opening Form Pdf: As we knew SBI is Nationalised bank of India. So the Risk of Bank Bankruptcy and NPA is low. That means our amount will be safe in Bank. Due to this reason Indians want to open accounts in Nationalized banks like SBI, BOI, etc.

Today We will give you information about SBI account opening Procedure. For such a relevant information follow our channel.

Information About SBI

State Bank of India is an Indian multinational, public sector banking sector. Also it is a financial services statutory body. Head quarter of SBI in Mumbai, Maharashtra.

SBI is the 43rd largest bank in the world. And ranked 221st in the Fortune Global list. Which is the world’s biggest corporation of 2020. SBI is the only Indian bank on this list. It is a public sector bank and the largest bank in India. With a 23% market share by assets. And a 25% share of the total loan and deposits market.

How to fill Account Opening Information

For opening SBI account you have to follow following procedure. Let’s start with the steps:

Download the above SBI Account opening form. That is Form 60 and Declaration. You can borrow it from SBI Branch whichever nearer to you. After that open Part-1 of the form. Fill the details according to procedure.

Account Opening Form:Part-1

Personal Details:

Fill your personal details in this section. Like Name, DOB, Gender, Address, Aaddhar card No, etc.

Address:

Mention Your Local and Permanent Address. ATM card and its pin will sent by Currier. So mention correct address.

In the Additional Details section, details about your occupation are necessary. As Bank categories you as Student or Employee or Businessperson. That’s why they want your salary slip or proof related to occupation. Also, a PAN card is essential for opening a bank account.

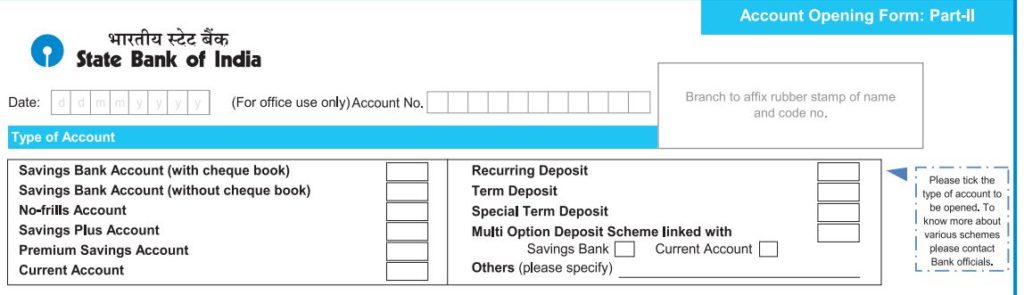

Account Opening Form:Part-2

In this section you have to fill information. About Type of Account, Service required, Signature etc.

Type Of Account:

In this section, you have to select which type of account you want. If you are an employee then you can choose a saving account.

A cheque book is essential for Loan purposes. So you must click the option of Saving account with a cheque book.

Recurring accounts means RD in general language. You can open an RD account for monthly savings. Term deposit accounts also helpful for saving money for a fixed time.

Details Of Applicants:

If you want to open joint account. Then this section is essential for you. You have to fill information about your joint partner.

Services Required:

In this section, you have to choose which type of service you want. Like Internet Banking, ATM-CUM-DEBIT Card, etc.

The bank gives you the best digital services. You should click all the digital services options. ATM-CUM-DEBIT Card is most essential for cash purposes.

Signature:

In this section, you have to stick recent Passport size photo. Also signed below boxes.

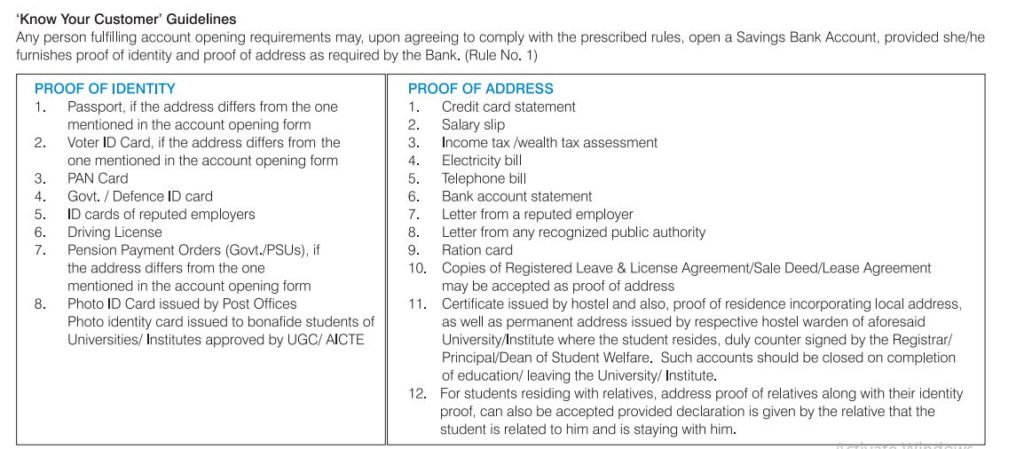

KYC

KYC means Know Your Customer. That means you have to attach your proof of identity. Documents that are required for it as mentioned below.

If You Don’t Have PAN Card

If you don’t have PAN card then you need to submit form 16, and also fill the nomination form.

How to download Form 16A from SBI website

SBI online banking is a free service for SBI customers. If you have registered for State bank of India Net banking then you can download Form 16A from the SBI website. Just follow the following steps to download Form-16A (TDS certificate) using the SBI Internet banking facility.

1. Visit the SBI Official website (www.onlinesbi.com).

2. Login to your account by using your username and password.

3. Once logged in, select the “TDS Enquiry” link under the “Fixed Deposit” tab.

4. Next webpage you can see three options

(a) TDS financial year,

(b) NRO TDS enquiry and

(c) Download

5. Here, under the TDS financial year option, select “Live accounts” if your fixed deposit is still on-going. Or select “Closed account” if your FD has matured during the financial year.

6. Once selected, the screen will show you the details of your fixed deposits. Select the financial year from the drop-down menu. Click on the “Submit” tab.

7. After submission, the request for TDS enquiry will be generated along with a reference number.

8. TDS certificate will be available under the “Download” tab within 30 minutes. Only the fixed deposit accounts will be displayed on this page.

9. Once processed, click on “Request ID” to download or view the TDS certificate under the “Download” tab.

Below is SBI Saving Account Opening Form Pdf Download

For More Related PDF:

| Bank of Baroda neft form PDF download |

| Canara Bank RTGS/NEFT From 2021 PDF Free Download |

| RTGS Axis Bank Form PDF Free Download |